Mix: International Space Station, Real Estate, Bitcoin

The International Space Station is only 408km from the surface of the earth. That is less than four hours of highway driving in terms of distance.

This is the first of the Monday Mix - a (hopefully) weekly post that goes out on Mondays, covering a mix of topics.

International Space Station and the power of tooling

The International Space Station is only 408km from the surface of the earth. That is less than four hours of highway driving in terms of distance. For a place that is completely inaccessible to the average person, I found that surprisingly close when I read that statistic earlier today. Consider that if you could drive there, you could leave around lunchtime and be there before dinner that same day.

Now obviously we can't very well just hop in our cars and do that, but it lends an interesting thought about the power of tooling. The power to get things done is intertwined with the tools you have at your disposal. Two hundred years from now, travelling 400km vertically into space may be as simple as it is to travel 400km horizontally by airplane. But if it is, it is only because tooling has made it possible to do so. The only reason we consider travelling 400km on land a simple thing today is due to the efficiency of our tooling – that being our cars. Even 100 years ago, the accessibility, comfort, and ease of use of tools that could get you that distance were completely different than it is today.

With the right tools, impossible things become easy and boundaries become nullified. Perhaps solutions to some of the problems we face in business or life today are only one tool away.

But not all tools are as simple as picking up and using like a screwdriver. Some tools take years of practice and learning. Some take consistent effort over long periods of time – that's the category that I would put writing a blog into.

Then there are other tools that I would say are mental or even spiritual tools and they would have an entirely different method of use than anything we can pick up with our hands.

Regardless of the tool, tools provide an alternate method of accomplishing something that was otherwise impossible or extremely time or labour-intensive to accomplish without.

Real estate and the economy

July's real estate numbers were released last week revealing that home sales further slowed throughout last month across Canada. I began paying attention to the market earlier this year and it doesn't surprise me when these numbers came out. Prices were shocking at the beginning of this year and yet it still seemed like so many people were FOMO'ing into bidding wars, placing bids on houses that surely shouldn't be going for such prices. Fast-forward to today and it appears like some form of sanity has returned and houses that are listed at those overly inflated prices are now sitting for extended periods of time without offers and even without showings.

It seems like more rate hikes are coming at the next scheduled rate announcement on September 7th, particularly after seeing Tiff Macklem's comments about the Bank of Canada being "determined" to get inflation under control. And that should further grind sales to a standstill as the prices that houses were going for simply aren't affordable at current rates.

The best way to protect people from high inflation is to eliminate it. That’s our job, and we are determined to do it. Tuesday’s inflation number offers a bit of relief, but unfortunately, it will take some time before inflation is back to normal. We know our job is not done yet — it won’t be done until inflation gets back to the two per cent target.

- Tiff Macklem (Bank of Canada Governor)

Bitcoin and the S&P 500

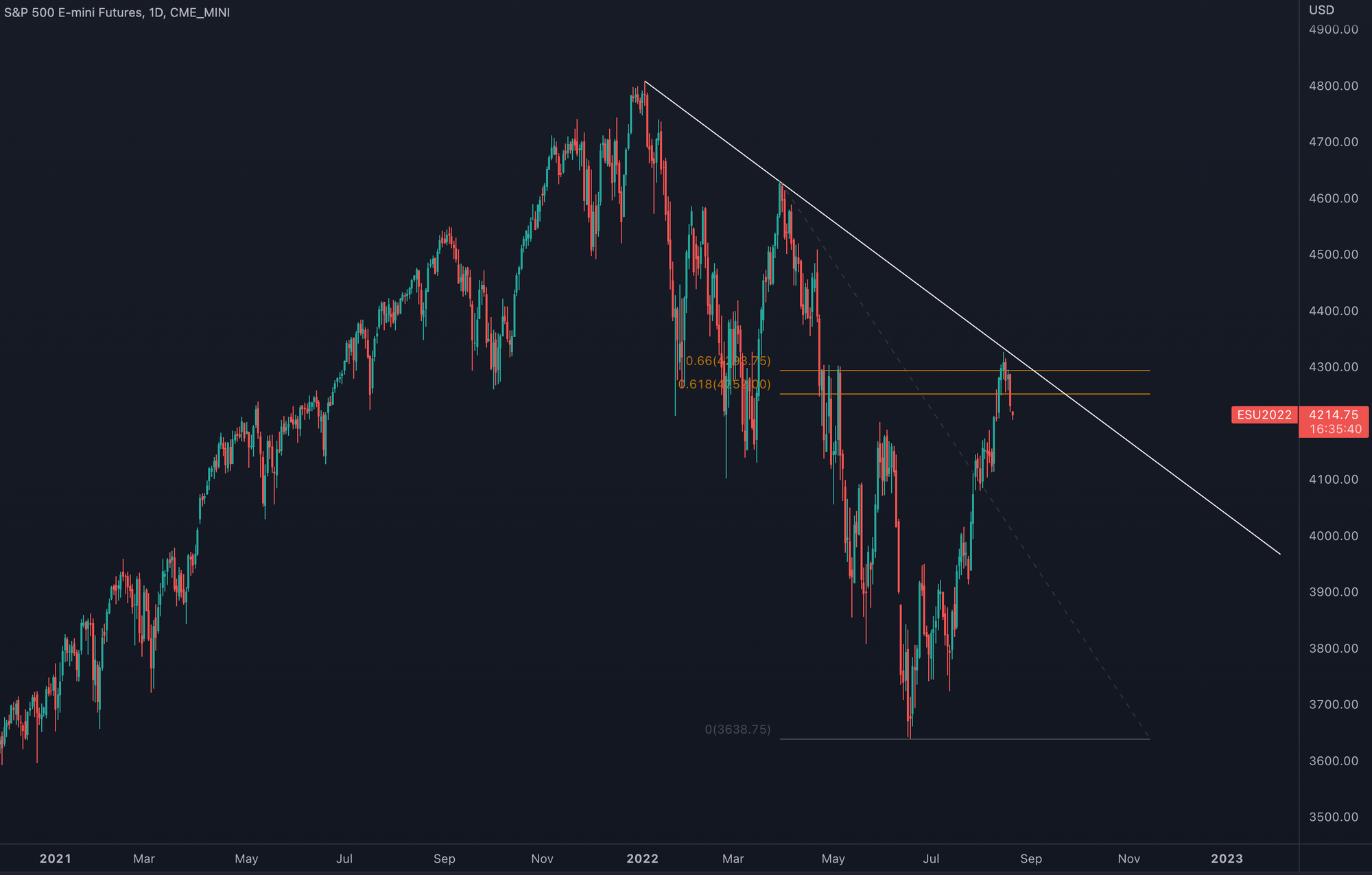

Bitcoin's current price at the time of this article is 21,395 and its price action is still well coupled with the S&P 500. We've been seeing a downward trend on both of these charts since November of last year.

As you can see from the charts above, we're currently at resistance of these trendlines so we're at a junction of either breaking out of this bearish trend or rejecting at the trend resistance line (the white diagonal line) and heading further down.

Based on the S&P's price action over the last couple of days, my futile prediction is that prices are headed further down for both.

That's all for today. My hope is that this post is the start of a consistent weekly Monday Mix series. Have a great week.